Exit Planning Mistakes That Cost Entrepreneurs Millions

How to avoid the costly oversights that can destroy decades of wealth building.

After 16 years of working with CEOs and entrepreneurs, I've witnessed both spectacular exits and devastating financial disasters. The difference often comes down to planning—or the lack thereof.

Most entrepreneurs pour everything into building their business but fail to plan their exit strategy until it's too late. This oversight can cost millions in unnecessary taxes, missed opportunities, and suboptimal deal structures.

The Million-Dollar Mistakes I See Most Often

1. Waiting Until the Last Minute

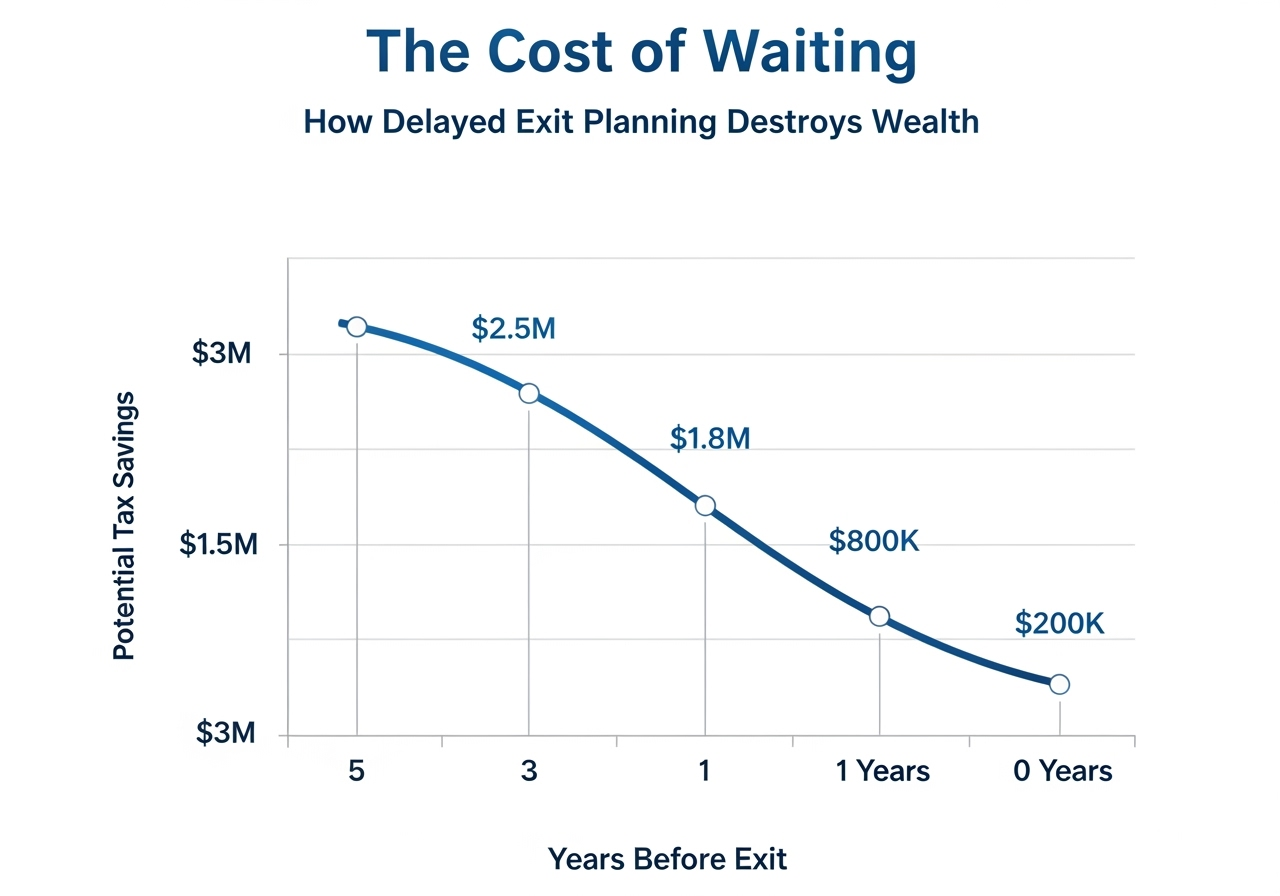

Figure 1: This powerful timeline visualization demonstrates the exponential cost of delaying exit planning for entrepreneurs. The chart shows potential tax savings lost over time, starting at $2.5 million in savings when planning begins 5 years before exit, declining to $1.8 million at 3 years, dropping dramatically to $800,000 at 1 year, and plummeting to just $200,000 when exit planning starts at the time of sale. The steep downward curve illustrates how procrastination literally costs entrepreneurs millions in unnecessary taxes and missed optimization opportunities.

The Mistake: Starting exit planning 6-12 months before selling The Cost: 15-30% reduction in after-tax proceeds The Fix: Begin exit planning 3-5 years before your target exit date

2. Ignoring Tax Optimization Strategies

The Mistake: Selling without implementing tax-deferral strategies The Cost: Paying 20-37% in capital gains when alternatives exist The Fix: Explore 1031 DSTs, Qualified Opportunity Zones, and charitable trusts

3. Over-Concentration in One Asset

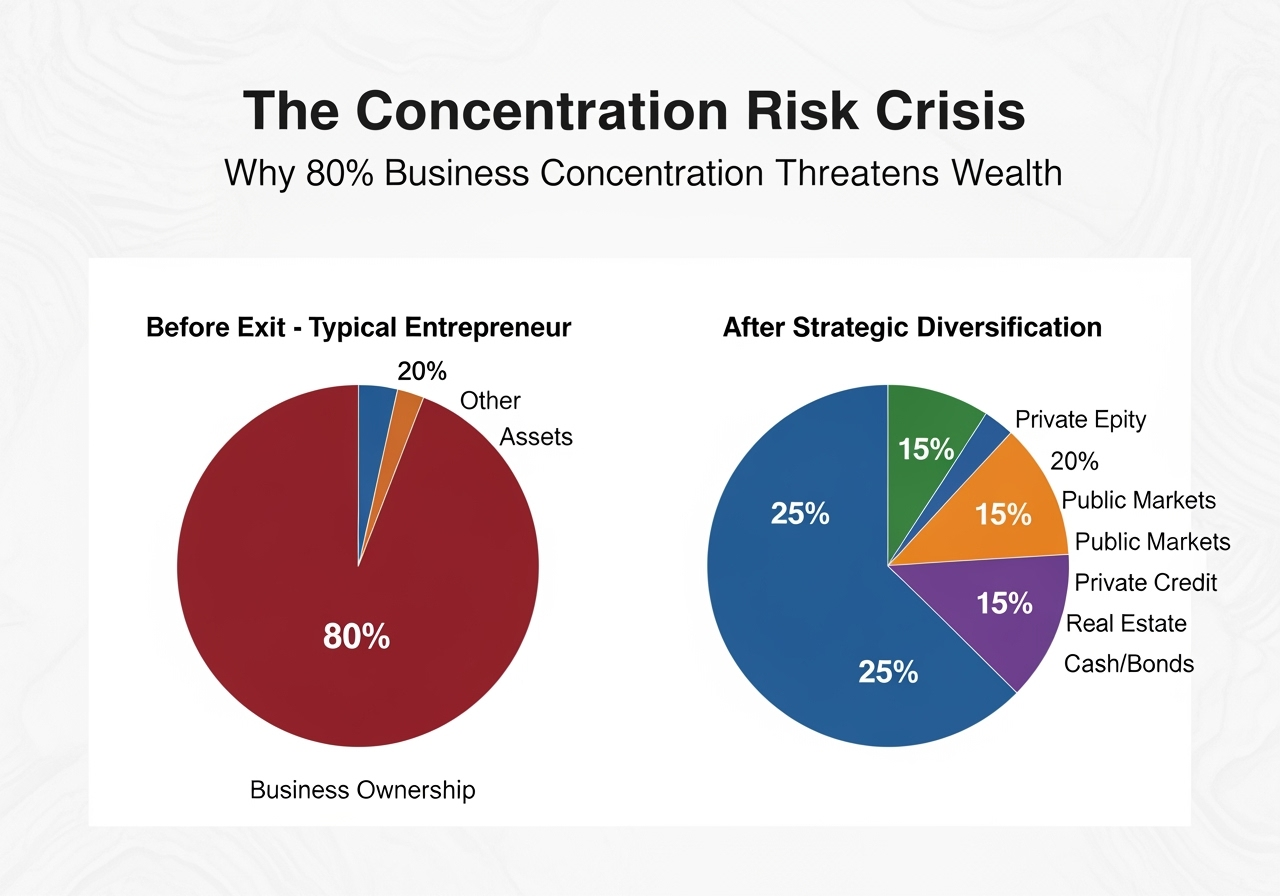

Figure 2: The stark reality most entrepreneurs face - 80% of their wealth concentrated in a single asset (their business) versus a strategically diversified portfolio that spreads risk across multiple asset classes. The left chart shows the dangerous concentration that keeps business owners vulnerable to catastrophic wealth loss, while the right chart demonstrates how sophisticated investors protect and grow their wealth through alternatives like private equity, private credit, and real estate investments.

The Mistake: Keeping 80%+ of net worth tied to the business The Cost: Catastrophic wealth loss if the business fails The Fix: Begin diversifying 3-5 years before exit through systematic wealth transfers

4. Poor Deal Structure Planning

The Mistake: Accepting the first offer without optimizing terms The Cost: $500K-$5M+ in lost value on mid-market deals The Fix: Understand earnouts, escrows, and payment structures before negotiations

5. Neglecting Post-Exit Wealth Management

The Mistake: Assuming traditional 60/40 portfolios will preserve wealth The Cost: Inflation erosion and missed growth opportunities The Fix: Access institutional-grade alternatives like private equity and private credit

The Smart Exit Strategy Framework

Years 3-5 Before Exit:

Implement tax-optimization strategies

Begin systematic diversification

Establish wealth management infrastructure

Create family governance structures

Years 1-2 Before Exit:

Finalize tax-deferral vehicles

Optimize business operations for sale

Engage M&A advisors and tax professionals

Prepare post-exit investment strategy

At Exit:

Execute tax-optimized transaction structure

Deploy proceeds across diversified alternatives

Activate ongoing wealth management plan

The Bottom Line

Your business exit represents the culmination of decades of hard work. Don't let poor planning destroy what you've built. The entrepreneurs who preserve and grow their wealth post-exit are those who treat exit planning as seriously as they treated building their business.

Ready to discuss your exit strategy? The best time to start planning was five years ago. The second-best time is today.